Climate-related disclosure has moved from a nice-to-have to a regulatory and investor expectation. But keeping up with evolving frameworks and standards can be overwhelming.

The Task Force on Climate-related Financial Disclosures (TCFD) helped shape a decade of climate risk reporting. Now, its recommendations are fully embedded in IFRS S2, the global standard developed by the International Sustainability Standards Board (ISSB).

In parallel, regulations like California’s SB 261, Australia’s upcoming Treasury Laws, and the UK’s Sustainability Disclosure Standards are using IFRS S2 as their foundation turning voluntary guidance into enforceable expectations.

This guide outlines 5 best practices for credible, forward-looking disclosure and how platforms like Disclose help you meet IFRS S2 requirements for physical climate risk reporting without internal bottlenecks or manual modelling.

5 best practices for a IFRS S2-aligned physical climate risk disclosures

IFRS S2 builds on the TCFD framework and elevates it from voluntary guidance to a mandatory reporting standard in several jurisdictions.

If you're reporting physical climate risk under TCFD-successor standards like SB 261, UK, SRS S2, AASB S2, and others, these best practices will help ensure your disclosures are consistent, credible, and decision-useful.

1. Show your working

Climate-related financial disclosure is a journey, not a checkbox exercise. IFRS S2, building on the legacy of the TCFD framework, encourages continuous improvement and transparency over time.

Most companies are still maturing their internal capabilities for climate risk management. That’s expected. What matters is being clear about where you are today and how your reporting will evolve.

What to include:

- A brief explanation of your organisation’s climate risk reporting maturity

- A roadmap to improve coverage, accuracy, and integration into decision-making

- Clear linkage between climate-related risks/opportunities and financial impacts

- Acknowledgement of any current gaps in data, systems, or internal knowledge

This demonstrates to regulators and investors that you're building the right processes, not just ticking the box.

2. Ensure your analysis is forward-looking

Climate risks don’t follow historical patterns. That’s why both the TCFD framework and IFRS S2 standard emphasise forward-looking analysis, especially through scenario modelling.

While historical data still matters, disclosures must also reflect how future climate scenarios could affect your business over short, medium, and long-term timeframes.

This includes:

- Modelling risk exposure under different emissions pathways (e.g. business-as-usual, Emission Peak 2024, Paris-aligned)

- Understanding physical and transition risks across geographies and time horizons (short, medium, and long-term timeframes)

- Using climate intelligence to quantify potential financial impacts

Forward-looking analysis helps companies anticipate risks, not just explain past events. It also builds confidence with investors, auditors, and regulators looking for credible, science-based projections.

3. Make your report easy to navigate for external readers

Climate disclosures are often complex, technical, and long. But they don’t have to be difficult to follow.

Whether you’re disclosing under IFRS S2, UK, SRS S2, AASB S2, or other aligned standards, clarity and accessibility are essential, not just for compliance, but to support informed decisions by investors, boards, and regulators.

Make it easier to engage with your report by:

- Including a summary of key risks, metrics, and decisions at the start

- Organising content by the four core pillars (Governance, Strategy, Risk Management, Metrics & Targets)

- Using visuals to explain processes, value chain risks, or scenario outcomes

- Cross-referencing related sections for transparency (e.g. connecting risk metrics directly to strategic responses)

- Defining key terms and acronyms clearly, especially for non-expert readers

A well-structured, easy-to-read report increases confidence, reduces audit friction, and demonstrates that your climate strategy is not just a tick-box exercise, it’s embedded in decision-making.

4. Include the right level of detail to ensure transparency

Transparency is one of the core principles behind IFRS S2. Investors, regulators and assurance providers need to understand not just what your climate risks are, but how you identified, assessed and quantified them.

To build trust and meet assurance expectations, your report should clearly explain:

- What was assessed (e.g. physical and transition risks across assets, geographies, or operations)

- How the assessment was conducted (e.g. data sources, scenario selection, time horizons and tools used)

- Why these methods were chosen (e.g. relevance to sector, alignment with best practices, scientific credibility)

Use precise language and include references to models, thresholds, tools (like Disclose), and data sources. For example: “Physical climate risks were assessed using CMIP6-aligned models across three timeframes (2025, 2030, 2060), including metrics like CVaR to estimate financial exposure.”

Why this matters: Credible disclosures are specific, replicable, and defendable. Vague or generic reports raise red flags with investors and regulators. Transparent disclosures enable comparability, strengthen trust, and improve your ability to access capital and respond confidently to scrutiny.

5. Ground your reporting in your sector and business model

IFRS S2 is designed to be industry-agnostic but the best reports tailor their insights to the real-world context of the business.

Generic climate disclosures don’t resonate with investors or regulators. They want to see that you understand how climate risks and opportunities impact your specific operations, markets, and financials.

To strengthen your report:

- Use sector-relevant risks and metrics: e.g. flood risk for infrastructure, supply chain disruption for manufacturing, or stranded assets in real estate.

- Reference industry guidance: like SASB metrics or local regulatory expectations.

- Report on the hazards that actually affect your assets: don't aim to tick every box. Focus on the risks that are material in your specific context, based on geography, operations, and business model.

- Connect climate risks to your value drivers: e.g. asset values, operating costs, or financing conditions.

A boilerplate report suggests a low-maturity approach. By contextualising your disclosure, you signal readiness, material awareness, and long-term resilience, key factors for investor trust.

The benefits of credible physical climate reporting

High-quality climate disclosures don’t just satisfy regulatory requirements. They unlock real business value.

When companies invest in clear, science-backed climate reporting, they gain:

Better risk management

Understanding physical and transition risks helps you anticipate disruptions, protect assets, and strengthen operations. It also improves cross-functional coordination between ESG, finance, operations, and risk teams, and allows you to quantify the financial impact of climate risks to inform strategic planning, capital allocation, and compliance..

Competitive advantage

Detailed climate analysis can reveal efficiency gains, new market opportunities, and resilience strategies. Strong ESG performance increasingly influences customer choice, investor interest, and talent retention.

Access to capital

Clear, auditable disclosures help investors and lenders assess long-term risk. This can lower the cost of capital, improve ratings, and unlock access to green finance mechanisms.

Trust and transparency

Investors, auditors, and stakeholders expect transparency. Robust climate disclosures show you're not just ticking boxes, you're managing material risks in a way that supports long-term value.

Reporting drives internal clarity. The process helps organisations build the capacity, data, and decision frameworks they need to take action on climate risk, not just report it.

Upgrade your TCFD-aligned report with Disclose

With TCFD now embedded into IFRS S2, and physical climate risk reporting becoming mandatory under laws like the UK’s Sustainability Disclosure Standards, California's SB 261, and others, the pressure is on for companies to deliver transparent, scenario-based disclosures.

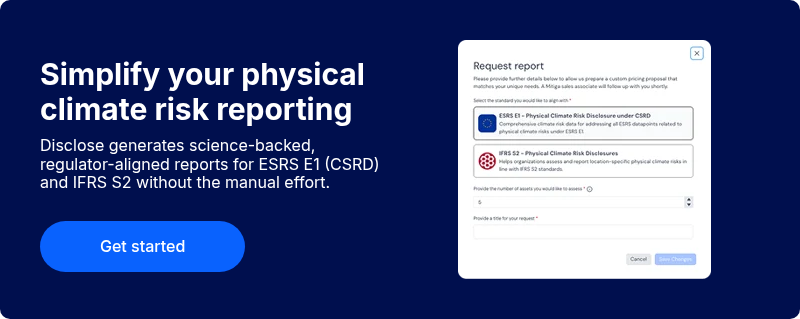

Disclose is Mitiga Solutions’ physical climate risk reporting tool built to align with both ESRS E1 and IFRS S2, serving organizations reporting under European and non-European frameworks alike.

It turns a simple CSV of asset locations into a science-based, disclosure-ready report.

You get:

- Asset-level insights on physical climate risks from hazards like flood, wildfire, heat stress and drought

- Scenario-based outputs aligned to three timeframes (2025, 2030, 2060) and three emissions scenarios

- Pre-filled Excel templates mapped to IFRS S2 and ESRS E1 datapoints

- Drafted disclosure narratives, using regulatory language

- Audit-friendly financial indicators, including CVaR for flood and extreme wind

No manual modelling. Just data you can trust, ready in minutes.

Disclose helps internal teams and ESG consultants cut reporting time, avoid duplication, and meet growing demands across regions. Get started and see how Disclose works in action.