The Corporate Sustainability Reporting Directive (CSRD) is changing how companies report on sustainability. It applies to over 50,000 businesses in and outside the EU, and brings climate risk, governance, and double materiality into scope for annual disclosures.

If your company operates in Europe, there’s a good chance you’ll need to comply. This guide explains what CSRD is, who it applies to, when the rules take effect, and how to prepare.

You’ll also find links to practical resources, including how to report physical climate risk under ESRS E1, how CSRD compares to other frameworks like TCFD, and how EarthScan Disclose can help you meet physical risk disclosure requirements.

What is CSRD?

The CSRD is the European Union’s latest sustainability reporting law, a mandatory framework that redefines how companies disclose environmental, social, and governance (ESG) information.

It builds upon and replaces the earlier Non-Financial Reporting Directive (NFRD), expanding both the scope of who must report and the level of detail required.

At the core of the CSRD is the concept of double materiality, meaning companies must explain how sustainability issues affect their business (financial materiality) and how their activities impact people and the environment (impact materiality).

Disclosures must follow the European Sustainability Reporting Standards (ESRS), a detailed rulebook covering everything from climate change and biodiversity to workforce conditions and governance.

Reports must be audited and submitted in digital format, starting from 2025 (for FY2024 data), for the first wave of companies.

Understanding CSRD double materiality

One of the most important (and often misunderstood) features of CSRD is the principle of double materiality.

Unlike traditional financial reporting, which focuses only on how risks affect your business, double materiality requires companies to also assess how their business affects the world.

Under CSRD, you must disclose on two fronts:

- Financial materiality: How environmental and social risks impact your company’s performance

- Impact materiality: How your company’s operations impact people and the environment

This dual lens ensures your report reflects both exposure and responsibility and helps investors, regulators, and stakeholders see the full picture.

After running a double materiality assessment, if a topic (e.g. biodiversity or water use) is not material, you can omit it as long as you document why.

Example of double materiality in real estate

The real estate sector offers a clear example of double materiality in action, as buildings both impact and are impacted by sustainability factors, but this principle applies across all industries, each with their own material sustainability considerations.

Financial materiality in real estate

Real estate companies must report on how climate risks affect their financial performance. For example:

- Physical climate risks: Extreme weather occurrences, like floods and heatwaves and the rising sea levels pose climate risks that could harm structures and result in higher insurance expenses while also decreasing property worth.

- Regulatory risks: New energy efficiency regulations, such as the Energy Performance of Buildings Directive, in the EU could necessitate improvements to adhere to environmentally friendly building criteria.

- Market risks: The real estate market faces a challenge as tenants and investors now lean towards energy efficient buildings, over older properties that are losing their edge in competitiveness.

Impact materiality in real estate

Real estate also has a significant environmental and social impact, which companies must disclose. Key areas include:

- Carbon footprint of buildings: Buildings contribute to around 40% of carbon dioxide emissions due to factors like the materials used in construction and energy consumption for maintaining temperature levels within the structures.

- Biodiversity impact: New developments may lead to deforestation and the destruction of habitats.

- Social impact: Large-scale projects can displace communities or affect local infrastructure.

By considering both financial and impact materiality, companies can:

- Identify and prioritise key ESG topics: Companies can focus on sustainability issues that genuinely impact their business and stakeholders rather than reporting on irrelevant ESG factors.

- Improve decision-making: Helps businesses integrate sustainability into corporate strategy, risk management, and long-term financial planning.

- Enhance transparency for investors and regulators: Provides a clearer picture of how ESG factors impact business resilience and long-term success.

- Meet regulatory and market expectations: Investors, customers, and regulators increasingly demand credible sustainability disclosures.

Tip: Climate risk is often one of the most material topics under CSRD. That’s why many companies start with ESRS E1. If it’s material for your business, explore our full ESRS E1 reporting guide for a step-by-step breakdown.

Who needs to report under CSRD?

The CSRD applies to over 50,000 companies, including many outside the EU. You’ll fall within scope if your company meets certain size thresholds or if you operate in the EU market, even indirectly.

Here's how it breaks down:

CSRD reporting requirements by company type

Who qualifies as an SME under CSRD?

CSRD defines SMEs as companies that meet at least two out of three of the following thresholds:

Not directly in scope? You might still be affected. If you're part of the supply chain for a reporting company, expect more ESG data requests from clients, partners, or investors.

When do you need to start reporting?

The CSRD rollout is staggered based on company type. The table below shows when different groups must publish their first reports.

CSRD reporting timeline

Keep in mind: Although reporting deadlines are still years away for some companies, materiality assessments, data collection, and internal processes should start much sooner.

The Omnibus update: What changed in 2025

In response to industry concerns, the European Commission introduced a set of changes under the Omnibus Package to ease CSRD compliance.

The update includes:

- Raised thresholds: Companies with fewer than 1,000 employees are now out of scope, significantly reducing the number of firms that must report.

- Timeline delays: Wave 2 and 3 companies now have two extra years to comply, giving them more time to prepare internal processes and data systems.

- Voluntary standard for SMEs (VSME): Smaller firms can now use a simplified reporting framework if they choose to disclose.

- Simplified ESRS requirements: A major revision of the European Sustainability Reporting Standards is underway, aimed at reducing duplication and complexity.

Tip: Even if your deadline is a few years away, starting now can reduce compliance costs and strengthen your climate reporting readiness.

What does CSRD reporting cover?

The CSRD requires companies to report across 10 key ESG topics, outlined in the European Sustainability Reporting Standards (ESRS). These standards cover environmental, social, and governance issues, but not all of them will be material to every business.

After a double materiality assessment, companies must disclose in detail where impacts, risks, or opportunities are deemed material.

Here’s a high-level overview of the 10 reporting areas:

How to prepare for CSRD: A step-by-step guide

Getting CSRD-ready doesn’t need to be overwhelming. These practical steps can help your team prepare with confidence:

1. Check if you're in scope

Use the updated thresholds and deadlines to confirm if and when your company must report.

2. Run a double materiality assessment

Identify which ESG topics, including climate risk, are material to your business and stakeholders.

3. Map your value chain

Understand where your sustainability impacts and risks lie, across operations, suppliers, and downstream partners.

4. Centralise ESG and asset-level data

Break down silos by combining finance, ops, and sustainability data in one place. Make sure it's granular enough for ESRS.

5. Conduct a climate risk screening

Assess exposure to physical risks like heatwaves, flooding, or drought using scenario analysis and asset-level granularity.

6. Align with ESRS formats

Familiarise your team with the structure of the ESRS and how each disclosure topic is reported.

7. Build reporting into your governance processes

Involve board-level oversight early and define clear roles across departments.

8. Engage your assurance provider

External assurance is mandatory. Start the conversation early so your systems meet audit-ready requirements.

9. Choose tools that reduce manual effort

Platforms like EarthScan Disclose help automate the most time-consuming parts, from data prep to report generation.

Download our free CSRD checklist to guide each step, from assessing risks to deliver assurance-ready reports without the usual complexity.

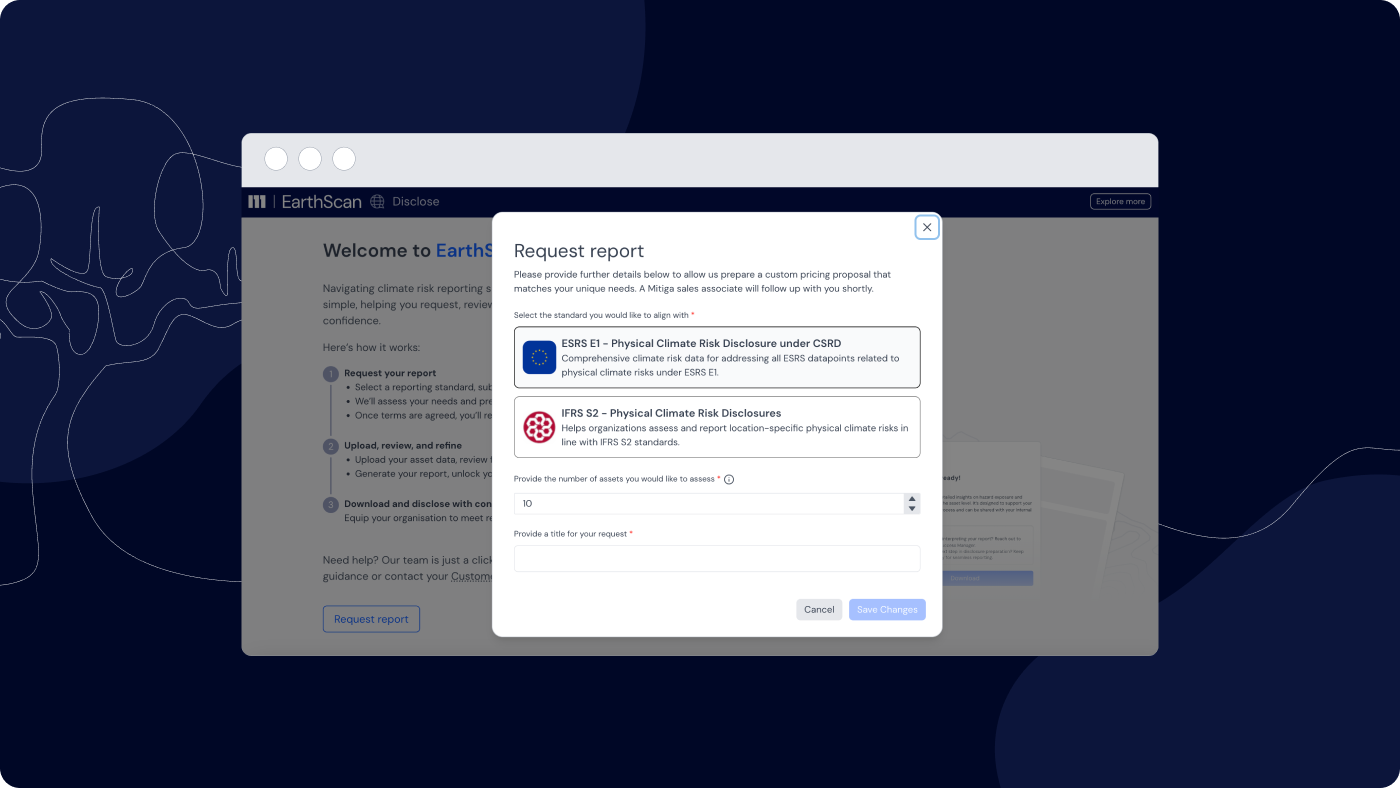

Disclose: A faster way to report climate risk

Reporting physical climate risk under CSRD is complex, especially when it comes to meeting ESRS E1 requirements. Disclose simplifies the process.

It helps you:

- Assess location-specific physical climate risks, including flooding, extreme heat, drought, and wildfire, using scenario-based modelling across multiple climate pathways.

- Generate ESRS E1-aligned outputs that meet regulatory expectations for granularity, consistency, and auditability.

- Export submission-ready reports in minutes using automated processing tools. No in-house climate modelling expertise required.

Designed for sustainability teams, consultants, and ESG leads, Disclose provides structured, audit-ready outputs aligned with ESRS E1. By automating complex data processing and scenario analysis it frees up time and resources for strategic planning and internal coordination.

Confused about how CSRD compares to TCFD or IFRS S2? Learn more: How CSRD compares to TCFD, SFDR and IFRS.

Conclusion: What to do next

CSRD is no longer a future requirement; it’s already reshaping how companies report on sustainability and climate risk. Whether you're a large business, a listed SME, or a non-EU firm operating in Europe, there's a high chance you’ll need to comply.

The earlier you start preparing, the easier it becomes to avoid last-minute gaps, expensive consultant dependencies, and compliance risks.

If physical risk reporting under ESRS E1 is on your roadmap, Disclose offers a fast, reliable way to get started turning asset data into submission-ready outputs in minutes.

FAQs

What is CSRD?

The Corporate Sustainability Reporting Directive (CSRD) is the EU’s mandatory ESG reporting regulation. It replaces the NFRD and requires companies to report on environmental, social, and governance topics.

What does CSRD stand for?

CSRD stands for the Corporate Sustainability Reporting Directive, a European Union law that requires companies to report on environmental, social, and governance (ESG) risks and impacts.

When was CSRD introduced?

The CSRD was officially adopted by the European Union in November 2022 and entered into force in January 2023.

When does CSRD come into force?

The CSRD reporting requirements begin in 2025 for the first group of companies, covering data from the 2024 financial year. Other companies will follow in phases through to 2029.

When do CSRD requirements begin?

The first wave of companies began reporting in 2024. Most others must comply by 2026 or 2028, depending on size and scope. The Omnibus update in 2025 granted delays for certain groups.

Who needs to comply with CSRD?

Large EU companies, listed SMEs, and non-EU firms with significant EU operations. Specific thresholds apply for turnover, assets, and employee count.

Does CSRD apply to UK companies?

Yes, CSRD can apply to UK companies if they have a significant business presence in the EU, specifically, if they generate over €150 million in EU turnover and have an EU branch or subsidiary with at least €40 million in revenue.

Does CSRD apply to private companies?

Yes, CSRD applies to both public and private companies if they meet the size criteria, including turnover, assets, or employee thresholds.

What is ESRS E1?

ESRS E1 is the climate disclosure standard under CSRD. It requires reporting on physical and transition climate risks, emissions, mitigation, and adaptation strategies.

How can Disclose help?

EarthScan Disclose gives you asset-level climate risk analysis and ready-to-submit reports aligned with ESRS E1, helping you save time, reduce costs, and meet CSRD obligations with confidence.

Is CSRD mandatory?

Yes, for companies that meet the size or listing criteria.

What is CSRD double materiality?

Double materiality under CSRD means companies must report on how sustainability issues affect their business (financial materiality) and how their business activities impact people and the environment (impact materiality).

What’s the deadline to start reporting on CSRD?

For most companies, CSRD reporting starts in 2026, using 2025 data. But it depends on company size.